Games

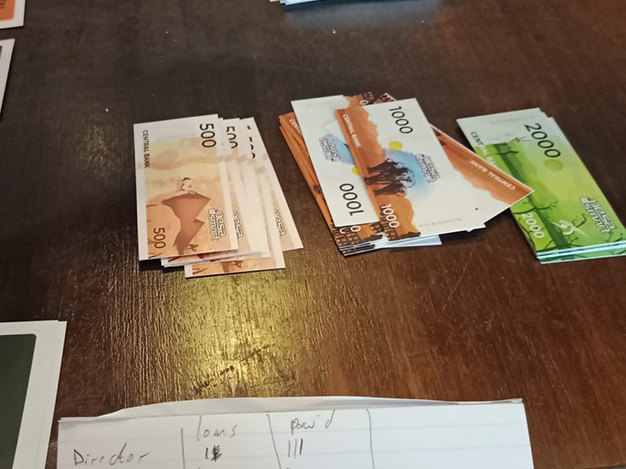

Loan Cards

These are played at any time in the game at the point where a player needs to borrow money to purchase an asset or pay off an expense. A player can get loans in tranches of 5000 and pays back 1000 per round for six rounds

Games

Death Cards

This card jolts the game and also acts as a secondary goal to survive it. It will also teach players that death should not necessarily mean that a household’s financial status has to suffer.

Games

Expense Cards

The expense cards will remove money from the player. They will be a mixture of recurring expenses e.g. food, bills and unexpected expenses like illness or fire. A player can defer up to a maximum of 2 expense cards. Tax and death cards have to be paid immediately. These two cannot be deferred.

Games

Income

The Income Cards are investments that will provide an asset base to the player.

Games

Protection Cards

Cards like the “Insurance cards”, “professional fees”, “Will” cushion players against unexpected expenditure.

Fun & EducativeAn interactive group physical card game

Fun & EducativeAn interactive group physical card game PESASMART - ABOUT MONEYPESASMART TEACHES CRITICAL THNKING

PESASMART - ABOUT MONEYPESASMART TEACHES CRITICAL THNKING EASY TO LEARNBe smart playing the cards

EASY TO LEARNBe smart playing the cards